Our Products

At aqeel, we focus on helping small and medium-sized businesses (SMBs) manage their money better. We have designed both our platform and our products with the user in mind. This post gives a brief overview of what we offer and how it can help any business.

We offer two core products:

- Payment Term Extension: This product is made for both buyers and suppliers. If you're buying or supplying goods or services, you can upload the invoice to aqeel. As a buyer, you can request a payment term extension and as a supplier, you can offer longer payment terms to your buyers. The payment term extension can be chosen flexibly so that it matches the expected revenue collection cycle of the buyer. aqeel will pay the supplier at the original invoice date and the buyer will then pay aqeel once they have collected revenue from their customers and thereby have the necessary cash at hand. For this product, the buyer always bears the cost of extending a payment term.

- Early Pay: This product is specifically tailored for suppliers. Suppliers can upload an invoice for the delivery of goods and services rendered onto the aqeel platform and request and for early payout on the outstanding account receivable. This allows suppliers to get their money sooner instead of waiting for the buyer to pay by the invoice due date. For this product, the supplier always bears the cost of an early payout.

We have designed these products to enable SMBs to improve their cash conversion cycle. Any user signed up to our platform can use both products flexibly in whatever way most suitable to their specific cash flow situation.

There are particularly two scenarios when this is important.

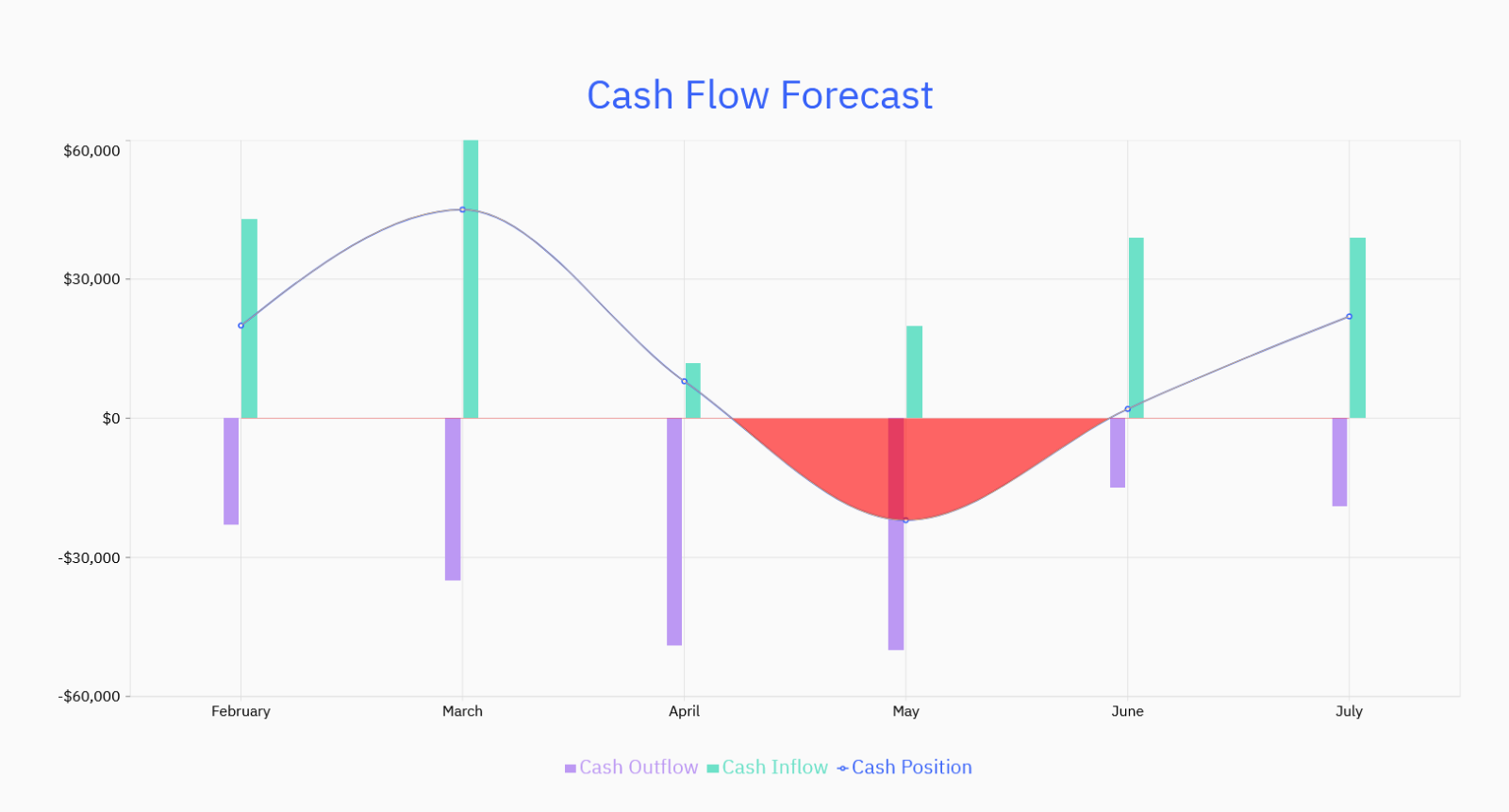

1) In a high growth phase: As we have explained in our blog post “Why payment terms matter”, the cash conversion cycle in an expansionary phase tends to increase, as there is an uptick in CAPEX (inventory or production capacity (PP&E)) to drive growth. However, the return on these investments tends to be realized with a considerable time lag, meaning that short-term cash outflows are higher than short-term cash inflows.

2) In a decline phase: When there is a sudden drop in demand for a company’s products or services, short-term payables tend to outweigh short-term receivables. Whether this is a temporary or structural change, it takes time for management to make adjustments – time that the cash position of an SMB can typically not buffer.

Both scenarios can lead to a negative cash position in the company that often can’t be bridged without external debt or cash infusions by owners or investors. With aqeel, companies can now reliably forecast their cash position and recognize and eliminate any cash gaps with the use of our Payment Term Extension or Early Pay products.

Combined with aqeel’s cash flow forecasting tool, the quickly accessible Payment Term Extension and Early Pay products are ideal for use on an as-per-need basis – only when there is an upcoming cash gap. This saves interest costs and buys the management time to make structural changes, if necessary.

Our products are designed to empower companies to achieve a balanced cash flow, without the need to take out excessive debt and sell equity. In this case study, read how our customer Knoxlabs has successfully been using both of our products to smoothen cash flow amid supply chain disruptions and a growth in demand.

Please check out our FAQ section for more information on our products.

Visit aqeel for more information or contact us at hello@getaqeel.com.