Why payment terms matter

Negotiating payment terms can be annoying and most business owners have experienced this before. Suppliers want to be paid as soon as possible yet buyers want to pay as late as possible. If you are a small business, you especially have little to no negotiation power and must accept terms that are unfavorable to you.

Waiting for your cash is not only frustrating, but it could also be deadly for your business. We came across this thoughtful thread on X from @TheSecretCFO that inspired us to include the example below in our conversations with customers. From our experience, most business owners often do not realize the danger of facing short payment terms on purchases, while at the same time providing long payment terms to their customers on sales. What’s even worse, this can pose an existential threat to highly profitable, growing businesses.

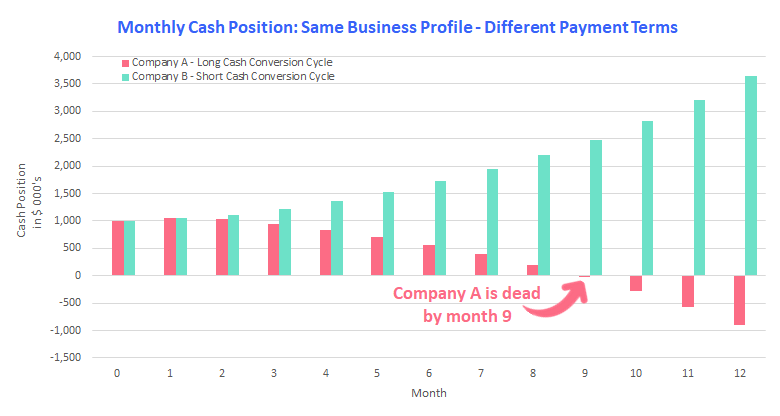

In this example, starting at month 0, two businesses have the same cash reserves, the same operating margins, and the same monthly growth rate. Both businesses are highly profitable. The only difference is between the payment terms they receive from suppliers and the payment terms they provide to their customers. Company A has short payment terms from suppliers and provides its customers with long payment terms; it therefore has a long cash conversion cycle. Company B has long payment terms from suppliers and provides its customers with short payment terms; it therefore has a short cash conversion cycle.

Company A's long cash conversion cycle does not have a material impact in stable (non-growth) business periods. However, this changes when both businesses hit a growth streak of 15% per month (we chose 15% growth per month as an extreme example for illustration purposes, but the broader principle is that growth should be desirable for any business). Once purchase orders for both companies start to increase and both companies need to pay for this additional growth, Company A has depleted its cash and could face bankruptcy by month 9 (based on the assumptions we made in our example).

On the other hand, Company B is thriving and has over $3.5M in cash reserves by the end of the year that it can use to further invest in growth.

This is a simplified numerical example, but it helps to illustrate the problem of having unfavorable payment terms on both sides of a transaction (i.e. a long cash conversion cycle). In fact, Nike faced exactly this issue in its early days of high growth, as we have highlighted in a previous blog post. We were surprised by how many small business owners either do not realize the danger of having a long cash conversion cycle or are aware of this phenomenon and purposely choose to not grow their business because they cannot afford it.

We have started aqeel with the goal in mind to innovate cash flow management for small and medium sized businesses. With aqeel you can achieve the ideal cash conversion cycle for your business type and stage. Let your customers choose their own payment terms, while you get paid immediately. At the same time, pick your own payment terms for purchases from your suppliers. Check out aqeel to learn more or get in touch at hello@aqeel.finance.